This article argues that the oil price shocks of the 1970s triggered a wave of global financialization led by Western banks and the US State that disconnected actual production from social reproduction in hundreds of indebted countries after 1982. It draws on a case study of Citibank lending in Mexico, the first country (of dozens) to default on the spate of cross-border loans spurred by new petrodollar (oil/gas debt) recycling strategies. I argue that this turn to fictive production—now ubiquitous as a neoliberal strategy—as well as the accompanying social exclusion that results, calls for rethinking the concept of “mode of production” in efforts to characterize late capitalism.

A “mode of production,” to Karl Marx, referred to a “specific, historically occurring set of social relations through which labor is deployed to wrest energy from nature by means of tools, skills, organization and knowledge” (Wolf 1982: 75). Production meant both “active engagement with nature and the concomitant ‘reproduction’ of social ties” (ibid.). Implicit in this notion is reproduction of a labor force dependent on (capitalist-controlled) distribution of commodities generated through production. The case of Mexico’s debt illustrates how financing based on energy debt enabled globalization of neoliberal policies and displaced profit generation from production to speculative activities in many places. Unprecedented flows of economic refugees testify to the degree to which labor has become disconnected from the levers of power in financialized settings.

After the Mexican default in 1982, the Reagan Administration expanded the IMF’s conditionality beyond issues of domestic credit expansion and government deficits. The new prototype called on the IMF to enforce structural measures, including trade liberalization, privatization, and related economic policies. The IMF also became more directly involved in lending to indebted countries (Ahmed et. al 2001; Harvey 2005). By the late 1990s, this model had been imposed on dozens of newly indebted countries in Latin America, Africa, and Asia (Harvey 2005).

Through exaction of interest payments from South to North, which outstripped aid and investment flows into most countries, the IMF became the whip allowing restructuring of the world’s economy along neoliberal lines. The Mexican case offers insight into the particular relations between elite capitalists and the state that shepherded the Global South into a debt peonage relationship with a small coterie of Northern banks. Further, the oil dependency that sparked the crises illustrates the sociomaterial underpinning and unsustainable aspects of capitalist growth.

Unlike many least developed countries (LDCs), Mexico, as an oil-producing state, stood to gain from investments in oil production after OPEC’s historic 400 percent hike in prices in 1973. As recently as 1972, Mexico had enjoyed relatively low debt—only $218.7 million per year in net flow (Ponce de Leon 1985: 294)—and PEMEX, Mexico’s national oil company, had fulfilled its mandate, supplying just over 80 percent of domestic energy supplies to the nation, but at high cost (Quintanilla and Bauer 1996: 111).

But precisely because of access to new capital, linked with a new trend of large banks making cross-border loans, Mexico fell victim to a deadly pattern of spending and borrowing from which it has never emerged. Similarly, debt has soared in most developing countries with oil reserves. Even though such countries are better able to service debt, the increased debt they incur tends to leave them deeply indebted to the detriment of social development (Kretzmann and Nooruddin 2005).

The special relationship of oil and the US dollar is a key factor in this debt. Mitchell (2011) argues that since 1948, the dollar’s strength has been tied to the nation’s privileged access to oil—either domestic supplies or oil secured through geopolitical hegemony. The 1971 end of the gold standard caused a volatile and falling dollar, posing a problem for OPEC countries that were paid for oil in dollars, as well as for the United States, which carried heavy war debt and faced high inflation and new foreign trade competition.

Research by historians (based in part on formerly classified documents) verified that in late 1974 the United States struck a secret accord with Saudi Arabia to price oil in dollars, to invest a portion of oil profits in US Treasury bonds, and to deposit oil profits in major multinational banks based in New York and London in return for US military security for the regime and arms sales (Spiro 1999; Clark 2005). This accord set the stage for petrodollar recycling through private and public lending to LDCs, subsequent defaults, and IMF-supervised neoliberal reforms to enable restructured debts. David Harvey (2005: 16) described these petrodollar flows as helping to shore up US economic power in decades thereafter, in spite of the country’s soaring national debt—which, in terms of per capita in 2014, was higher than the debt of Greece (Bloomberg 2014). This power to maintain the dollar as the currency for oil trades creates high demand for dollars, since every country must use them to buy oil. Thus, international trade gravitates toward dollars as the most stable indicator of value.

Oil prices and Mexican debt

The first phase of borrowing in Mexico was initiated under President Luis Echeverría in 1973 as the country sought capital to recover from a drop in export income from the recession that followed the oil shock. External debt soared to $20 billion by 1976, and a large portion was owed to private foreign banks, which was something new. By 1976, Echeverría’s regime faced increasing capital flight and a fiscal crisis. The peso was allowed to float (a de facto devaluation), causing new poverty, a surge in immigration to the United States, and an IMF standby agreement. The president blamed the oil shock and recession (Ponce de Leon 1985: 304).

Central to the story of this new lending is Walter Wriston, the CEO of Citibank, who led the world’s banking system into cross-border lending to LDCs after 1973. Wriston maintained that countries don’t go bankrupt and that banks don’t need deep reserves of capital. In his biography of Wriston, Phillip Zweig (1996) paints him as a free market advocate who pushed relentlessly for looser bank regulations and cross-border money flows.

The new lending Wriston sought was a response to the profit crisis banks faced in the inflationary early 1970s (FDIC 1997). US laws prohibited banking across state borders and limited rates of interest paid. After the 1973 oil price hike, as OPEC’s petrodollar windfall was deposited in New York banks, Washington relaxed rules on foreign lending and Wriston aggressively opened new loan offices and bought out small banks. Citibank unilaterally announced a floating prime rate (to stabilize the interbank lending rate), further weakening the Fed’s control over lending. In the first five months of 1974, foreign assets of US commercial banks rose fourfold (Zweig 1996: 345, 388). Wriston believed Citibank’s “only card to play was international,” leading him to push for an international money transfer system. The result was Citibank International Bank Ltd. (CIBL), soon to be the world’s largest syndicator or packager of petrodollar debt. It was cheaper to do these loans in London, Nassau, or Panama, avoiding Federal Reserve regulations and state taxes.

In Mexico, a second phase of borrowing took place under President Lopez Portillo, who took office in 1976. Portillo announced Mexico had discovered new hydrocarbon reserves. Despite the recent crisis, this prompted “fierce competition among banks” to grant new loans to Mexico. Private debt grew from $6.8 billion in 1977 to $17 billion in 1980. The share of borrowing by Pemex itself rose to 40 percent of all public sector loans by 1979. Once again, high spending provoked a huge current accounts deficit, but the future seemed rosy, with oil exports up fourfold in two years and other exports growing (Ponce de Leon 1985: 310).

Citibank’s new cross-border strategies motivated Chase, Bank of America, and J.P. Morgan to follow its lead, but no other bank compared in terms of size of loans or profits. “Measured by total deposits, Citibank was bigger and more powerful than many of the countries where it did business,” wrote Zweig (1996: 402). This led to a generation of “salesmen-bankers who combed the world for $500 million deals,” earning huge fees selling them to smaller banks. The system allowed small regional banks to play in the big leagues; bankers saw the risk as low, since Citibank shared the risks on the syndicated loans it marketed.

Although country officers were supposed to originate loans and CIBL was to sell them, in practice, “the tail often wagged the dog and CIBL often drummed up its own deals” before seeking countries abroad to “take a piece” of each deal (Zweig 1996). A large percentage of loans were for energy-related projects; indeed, Brazil, which also had a national oil company, defaulted shortly after Mexico. Rampant corruption and bad management were factors in both countries, illustrating the role of state collaboration with private capital.

After being elected in 1979, Margaret Thatcher greatly restricted the British money supply, raising LIBOR interest rates (the United Kingdom variant of the interbank lending rate) on international borrowers. In 1980, Paul Volcker, chair of the US Fed, copied Thatcher’s policy to reduce inflation, resulting in soaring US interest rates. Thereafter, borrowing countries were offered dramatically shorter terms for new loans (e.g., five years or fewer, down from thirty years in 1971) plus higher interest rates.

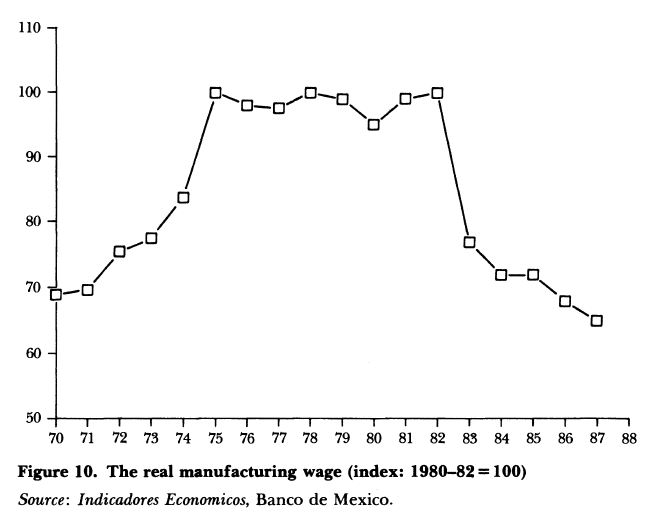

Then in 1981, with new Western oil production hitting markets, OPEC lost its leverage, and the price of oil began an abrupt decline. This was bad news for Mexico, which had counted on continued high prices. By that point, loans to LDCs were not aiding development but simply serving as Band-Aids for balance of payment problems, helping to maintain the existing standard of living. In mid-1982, with oil proceeds dropping and banks unwilling to extend new loans, Mexico defaulted on interest payments. Officials from the Reagan Administration put together a package of restructured debt, which involved the United States buying deeply discounted Mexican oil and imposing the first case of expanded IMF conditionality (Ahmed et al. 2001). Mexico serviced its debt with 6 percent of GDP from 1983 to 1988, severely cutting funds for social services. After a decade of steady decline, child mortality from malnutrition began to rise again, and workers saw sharp drops in real wages, averaging over 7 percent per year from 1983 to 1988 (Figure 1).

Figure 1: Rise and fall in manufacturing wages in Mexico, 1974–1982 (Dornbusch et al. 1988: 249). Note that the y-axis refers to an index (not actual wage amounts) in which real (after inflation) manufacturing wages are compared in terms of purchasing power prior to and after 1982, with the 1980–82 wage set at 100 percent.

Mexican immigration to the United States spiked to new levels after 1982 (Edwards 2006). According to Nora Lustig (1996): “The rich protected themselves by sending an estimated $36 billion abroad (from 1977 to 1987). The poor could not send money abroad. Instead, they exported themselves to the United States.” Indeed, as LDC defaults loomed, Citibank and other large banks had deposited billions from wealthy elites in countries where the banks lent money. Zweig noted the irony of the banks later blaming Latin Americans for capital flight, when every big bank operated a private banking division that “scoured the world” seeking those deposits (1996: 745).

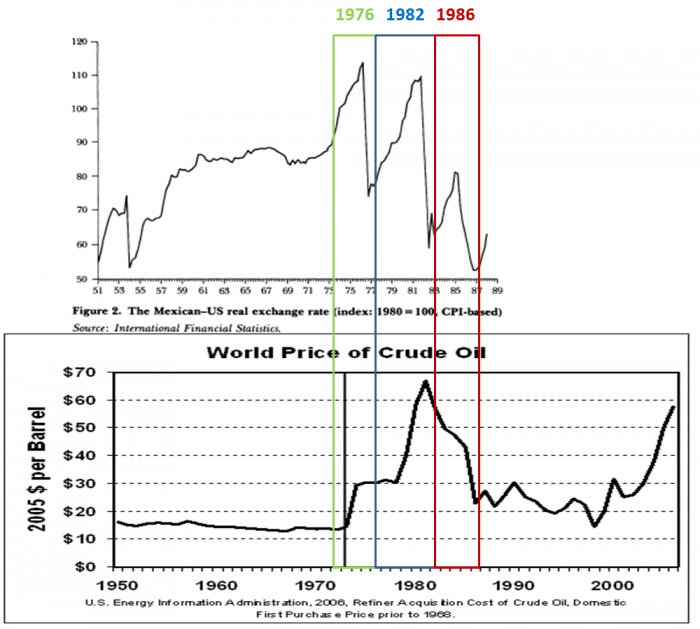

As can be seen in Figure 2, three devaluations of the Mexican peso occurred in the 1970s and ’80s, and all three cases corresponded to rapid changes in oil prices—the 1976 devaluation after a boom in lending when prices rose and the 1982 and 1986 devaluations associated with rapid declines in the price of oil.

Figure 2: Collapse of Mexican peso (versus USD) in 1976, 1982, and 1986 (Dornbusch et al. 1988: 235), compared to world price of crude oil (U.S. Energy Information Administration 2006).

International debt rose by 20 to 25 percent per year after 1973. Mexico and Brazil accounted for half of outstanding commercial bank debt. Fully half of non-oil-exporting LDC debt was owed to US banks. Harvey observed that in Latin America “whole economies were raided and their assets recovered by US finance capital … Two-thirds of IMF members experienced financial crisis after 1980, some two times or more” (2003: 66–67).

Constructing the capital–state nexus

Zweig’s account opens a window on the capital–state nexus in the United States: “While Citibank did not take orders from the State Department, it had become, in effect, a private sector extension of Foggy Bottom (1996: 438).” Zweig concluded that Wriston presided over the largest transfer of global wealth since the Marshall Plan and may have had more influence on policy than the secretary of state: “Through recycling, the United States, and especially US commercial banks, became the vehicle for projecting US economic power and principles into the underdeveloped world” (439). The lending aided US trade and capital accumulation and “helped extend a US financial presence around world” (Zweig 1996: 439; FDIC 1997).

Zweig’s biography of Wriston supports Harvey’s (2003) claim that when the United States was threatened in the realm of production, it asserted hegemony through finance. For this to work, “capital markets had to be forced open to international trade.” He noted that “uneven geographical conditions do not merely arise from natural distribution of resources, they are produced—and this is where politics enters in” (32).

Spiro (1999) described petrodollar recycling as giving the US a double loan: the first from OPEC—since, as long as petrodollars were invested in US Treasury bills, the US could print money to pay for oil (delaying having to produce goods and services for those transactions)—and the second from other economies that had to pay dollars for oil, since these countries had to trade goods and services for dollars to pay OPEC. As long as those petrodollars were thereafter invested in US Treasury notes, other countries too lent money to the US (121).

New production is an aspect of growth under late capitalism, but the Mexican case above illustrates well that what is being (re)produced is increasingly capital itself for corporate firms (and for the political machinery of states that back elite projects). This capital has a diminishing relationship with social reproduction of laborers, their families or the social networks and resources on which real community development depends.

So I have appreciated Nitzan and Bichler’s (2010) insistence that corporate profit be separated from production in analysis. In Capital as Power, they suggest the term “mode of power” rather than mode of production, since production is only part of the story—the point being not whether production is efficient or inefficient but rather how it relates to power. In a long-term comparative analysis, they note the tight correlation of oil company global profit share with the dollar price of crude (deflated by CPI) through a linear regression analysis in which R = 0.8 since 1974 and 0.92 since 1979. In contrast, profit was not highly correlated with the volume of oil output. Therefore, they argue, “oil assets partly capitalize government power” (297), which carries important implications for governance in this period of climate change and negotiations on carbon mitigation.

Both the US and Mexico rely on trading Treasury bonds to handle petrodollar debt. Mexico’s “tesobonos” were invented for this purpose. Nitzan and Bichler (2010) see the private sector’s interests and trade in government bonds—the heart of modern finance and the biggest pool of liquid securities—as evidence that theorists need to think of capital and the late-capitalist state not as complementary or overlapping but as integrated. If assets represent capitalized power, then capital incorporates government power. They argue that “in that sense government has become part of capital” (298).

What distinguishes financialization in late capitalism is this tight overlap of the hegemonic (US) state and capital—a collusion that evolved in a period when inflation, compounded by limits on vital resources (real and imagined), threatened conventional growth. In response, elites successfully lobbied to engineer new mechanisms for profit generation, which undermined or sidelined local and regional productive processes as a way of avoiding disruptions in the reproduction of surplus capital on which they depended. Unfortunately, the social cost of this process has been new forms of dispossession across the globe.

Sandy Smith-Nonini is Adjunct Assistant Professor of Anthropology at the University of North Carolina, Chapel Hill, and a founder of CommunEcos, an environmental education organization. She authored Healing the Body Politic (2010, Rutgers University Press) on health rights struggles in El Salvador and is writing a book on the farm labor movement in North Carolina. Her new research is on the political economy of oil.

References

Ahmed, Masood, Timothy Lane, and Marianne Schulze-Ghattas. 2001. Refocusing IMF conditionality. Finance & Development 38(4).

Clark, William R. 2005. Petrodollar warfare: Oil, Iraq and the future of the dollar. Gabriola Island, Canada: New Society Publishers.

DeWitt, R. Peter, and James Petras. 1979. Political economy of international debt: The dynamics of finance capital. In Jonathan D. Aronson, ed., Debt and the less developed countries. Boulder, CO: Westview Press.

Dornbusch, Rudiger, Jose Vinals, and Richard Portes. 1988. Mexico: Stabilization, debt and growth. Economic Policy 3(7): 231–283.

Duménil, Gérard, and Dominique Lévy. 2004. The economics of US imperialism at the turn of the 21st century. Review of International Political Economy 11(4): 657–676.

Edwards, James R. 2006. Two sides of the same coin: The connection between legal and illegal immigration. Backgrounder. Washington, DC: Center for Immigration Studies.

FDIC. 1997. The LDC debt crisis. In History of the eighties – Lessons for the future. Report by the Federal Deposit Insurance Corporation.

Harvey, David. 2003. The new imperialism. Oxford: Oxford University Press.

Harvey, David. 2005. A brief history of neoliberalism. Oxford: Oxford University Press.

Kretzmann, Stephen, and Irfan Nooruddin. 2005. Drilling into debt: An investigation into the relationship between debt and oil. Report by Oil Change International, Jubilee USA, Institute for Public Policy Research, Milieudefensie, and Amazon Watch.

Lustig, Nora. 1996. The 1982 debt crisis, Chiapas, NAFTA and Mexico’s poor. In Laura Randall, ed., Changing structure of Mexico: Political, social and economic prospects. Armonk, NY: M.E. Sharpe.

Mitchell, Timothy. 2011. Carbon democracy: Political power in the age of oil. New York: Verso.

Nitzan, Jonathan, and Shimshon Bichler. 2010. Capital as power: A study of order and Creorder. New York: Routledge.

Noreng, Oystein. 2002. Crude power: Politics and the oil market. New York: I.B. Tauris Publishers.

Ponce de Leon, Ernesto. 1985. The Mexican external debt: The last decade. In Miguel S. Wionczek, ed., Politics and economics of external debt crisis: The Latin American Experience . Boulder, CO: Westview Press.

Quintanilla, Juan M., and Mariano Bauer E. 1996. Mexican oil, gas, electricity generation, and energy consumption. In Laura Randall, ed., Changing structure of Mexico: Political, social and economic prospects. Armonk, NY: M.E. Sharpe.

Spiro, David E. 1999. The hidden hand of American hegemony: Petrodollar recycling and international markets. Ithaca, NY: Cornell University Press.

Wolf, Eric R. 1982. Europe and the people without history. Berkeley: University of California Press.

Zweig, Phillip L. 1996. Wriston: Walter Wriston, Citibank, and the rise and fall of American financial supremacy. New York: Crown Publishers.

Cite as: Smith-Nonini, Sandy. 2015. “Petrodollar financialization, the state, and fictive production.” FocaalBlog, 23 November. www.focaalblog.com/2015/11/23/sandy-smith-nonini-petrodollar-financialization-the-state-and-fictive-production.

Discover more from FocaalBlog

Subscribe to get the latest posts sent to your email.